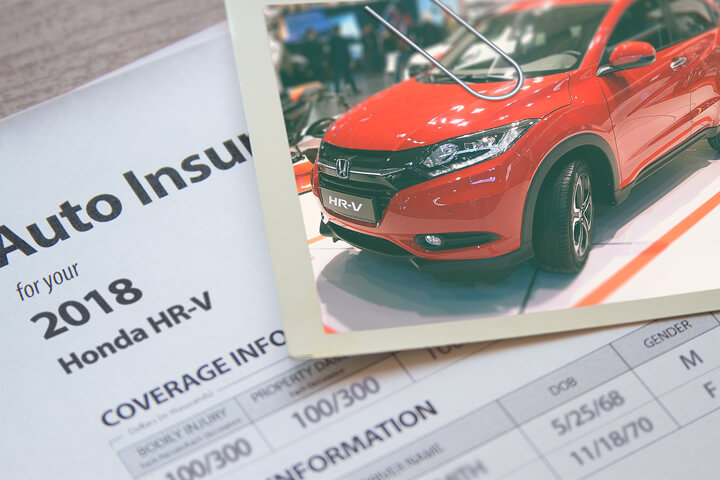

Honda HR-V insurance cost image courtesy of QuoteInspector.com

If price shopping Seattle car insurance quotes online is new to you, you can be overwhelmed due to the large selection of companies that all promise the best rates for Honda HR-V insurance in Seattle.

Astonishing but true, a large majority of drivers have remained with the same auto insurance company for four years or more, and 38% of drivers have never compared rates to find lower-cost insurance. With the average auto insurance premium being $1,847, American drivers could pocket about $850 a year just by shopping around, but they just don't understand the large savings they would see if they switched.

Astonishing but true, a large majority of drivers have remained with the same auto insurance company for four years or more, and 38% of drivers have never compared rates to find lower-cost insurance. With the average auto insurance premium being $1,847, American drivers could pocket about $850 a year just by shopping around, but they just don't understand the large savings they would see if they switched.

It's a good idea to quote other rates every six months since insurance prices are variable and change quite frequently. Despite the fact that you may have had the best quotes on Honda HR-V insurance in Seattle on your last policy other companies may now be cheaper. Block out anything you think you know about auto insurance because you're about to learn the fastest and easiest way to lower your annual insurance bill.

To find the cheapest Honda HR-V rate quotes, there are several ways to compare quotes from many available car insurance companies in Washington. The simplest method to find the cheapest Honda HR-V insurance rates is to perform an online rate comparison.

Keep in mind that having more price comparisons helps locate a lower rate than you're paying now. Some smaller insurers do not give online rate quotes, so it's recommended that you also compare quotes from the smaller companies as well.

The following companies can provide price quotes in Washington. If several companies are displayed, we recommend you visit several of them in order to get a fair rate comparison.

Cheap Seattle car insurance rates with discounts

Properly insuring your vehicles can get expensive, but companies offer discounts to help offset the cost. Some discounts apply automatically when you purchase, but a few must be inquired about before being credited.

- Own a Home and Save - Simply owning a home can save you money due to the fact that maintaining a home is proof of financial responsibility.

- Discounts for Multiple Vehicles - Purchasing coverage when you have primary and secondary vehicles on one policy can reduce rates for all insured vehicles.

- Anti-lock Brakes - Cars and trucks with ABS braking systems or traction control can reduce accidents and therefore earn up to a 10% discount.

- Telematics Data Discounts - Seattle drivers who agree to allow their company to analyze driving manner by using a telematics device in their vehicle such as Progressive's Snapshot and State Farm's In-Drive could see a rate decrease if they are good drivers.

- Passive Restraints and Air Bags - Factory air bags may qualify for discounts of 20% or more.

- Discount for Swiching Early - A few insurance companies give discounts for buying a new policy early. This discount can save up to 10%.

- No Claim Discounts - Good drivers with no accidents are rewarded with significantly better rates on Seattle car insurance quote as compared to bad drivers.

- Pay Now and Pay Less - If you pay your entire premium ahead of time as opposed to paying monthly you can actually save on your bill.

Discounts lower rates, but most discount credits are not given to the entire policy premium. Some only apply to the price of certain insurance coverages like medical payments or collision. Even though the math looks like adding up those discounts means a free policy, it doesn't quite work that way. But any discount will positively reduce your car insurance premiums.

Insurance companies that may have most of these discounts include:

If you need affordable Seattle car insurance quotes, ask each insurance company to give you their best rates. Discounts might not be available to policyholders in your area. If you would like to choose from a list of car insurance companies who offer car insurance discounts in Seattle, click this link.

Auto insurance is an important decision

Despite the potentially high cost of Honda HR-V insurance, maintaining insurance is required by state law in Washington and it also provides benefits you may not be aware of.

First, almost all states have minimum liability requirements which means it is punishable by state law to not carry specific limits of liability protection in order to get the vehicle licensed. In Washington these limits are 25/50/10 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

Second, if you have a lien on your vehicle, almost all lenders will make it mandatory that you buy full coverage to guarantee loan repayment. If you do not pay your insurance premiums, the lender may have to buy a policy to insure your Honda at an extremely high rate and force you to pay for the much more expensive policy.

Third, insurance safeguards not only your Honda HR-V but also your financial assets. It will also provide coverage for most medical and hospital costs for you, any passengers, and anyone injured in an accident. Liability insurance, one of your policy coverages, also covers legal expenses if you are named as a defendant in an auto accident. If your Honda gets damaged, comprehensive (other-than-collision) and collision coverage will cover the repair costs.

The benefits of buying auto insurance more than cancel out the cost, especially with large liability claims. According to a 2015 survey, the average American driver overpays more than $700 annually so it's important to compare rates at every renewal to make sure the price is not too high.

Insurance agents can help

Always remember that when buying a policy for your personal vehicles, there really isn't a cookie cutter policy. Everyone's situation is unique and your policy should reflect that. For instance, these questions can help discover if you would benefit from an agent's advice.

For instance, these questions can help discover if you would benefit from an agent's advice.

- Am I better off with higher deductibles on my Honda HR-V?

- How much coverage applies to personal belongings?

- Am I covered when using my vehicle for business?

- When should I not file a claim?

- Do I need higher collision deductibles?

- Is a new car covered when I drive it off the dealer lot?

- Should I put collision coverage on all my vehicles?

- Am I covered when driving in Canada or Mexico?

- Should I rate my Honda HR-V as pleasure use or commute?

- Who is covered when they drive my Honda HR-V?

If you're not sure about those questions but one or more may apply to you then you might want to talk to an insurance agent. To find lower rates from a local agent, fill out this quick form or go to this page to view a list of companies.

Local Seattle insurance agents

A lot of people just prefer to buy from a local agent and that is not a bad decision The biggest benefit of comparing insurance prices online is the fact that drivers can get cheap insurance rates and still have an agent to talk to. And supporting neighborhood insurance agencies is important especially in Seattle.

To make it easy to find an agent, after completing this short form, your information is immediately sent to local insurance agents in Seattle who will give you quotes to get your business. There is no reason to search for any insurance agencies since price quotes are sent to you instantly. You can most likely find cheaper rates without having to waste a lot of time. In the event you want to quote rates for a specific company, you just need to navigate to their website and fill out the quote form the provide.

Shown below is a short list of car insurance companies in Seattle that can give you price quotes for Honda HR-V insurance in Seattle.

- Adams Insurance

8613 35th Ave NE - Seattle, WA 98115 - (206) 523-8660 - View Map - Sound Insurance Agency, Inc.

9627 Aurora Ave N - Seattle, WA 98103 - (206) 527-0888 - View Map - Cairns Insurance Agency

13751 Lake City Way NE #214 - Seattle, WA 98125 - (206) 368-8117 - View Map - Grange Insurance Association

200 Cedar St - Seattle, WA 98121 - (800) 247-2643 - View Map

Selecting an provider requires you to look at more than just the price. The answers to these questions are important, too.

- What are the financial ratings for the companies they represent?

- Are they properly licensed to sell insurance in Washington?

- Is vehicle mileage a factor when determining depreciation for repairs?

- How is replacement cost determined on your vehicle?

- Can glass repairs be made at your home?

- Are there any hidden costs in their price quote and does it include driving and credit history?

- Are they primarily personal or commercial lines agents in Seattle?

- How much training do they have in personal risk management?

Insurance policy coverages for a Honda HR-V

Learning about specific coverages of a insurance policy can be of help when determining which coverages you need for your vehicles. The terms used in a policy can be impossible to understand and even agents have difficulty translating policy wording. These are typical coverage types available from insurance companies.

Medical payments coverage and PIP

Med pay and PIP coverage pay for bills for things like nursing services, funeral costs and surgery. They are used to cover expenses not covered by your health insurance policy or if you lack health insurance entirely. They cover both the driver and occupants and also covers any family member struck as a pedestrian. PIP coverage is not universally available and gives slightly broader coverage than med pay

Uninsured/Underinsured Motorist coverage

Your UM/UIM coverage protects you and your vehicle's occupants from other drivers when they are uninsured or don't have enough coverage. Covered claims include injuries to you and your family and also any damage incurred to your Honda HR-V.

Due to the fact that many Washington drivers have only the minimum liability required by law (which is 25/50/10), their liability coverage can quickly be exhausted. This is the reason having UM/UIM coverage should not be overlooked. Frequently the UM/UIM limits are identical to your policy's liability coverage.

Comprehensive coverage

This coverage covers damage that is not covered by collision coverage. You need to pay your deductible first and the remainder of the damage will be paid by comprehensive coverage.

Comprehensive insurance covers claims such as damage from getting keyed, vandalism, hitting a bird and falling objects. The maximum amount a insurance company will pay at claim time is the market value of your vehicle, so if it's not worth much more than your deductible consider dropping full coverage.

Auto liability insurance

Liability coverage can cover damages or injuries you inflict on people or other property that is your fault. This coverage protects you from claims by other people. Liability doesn't cover your injuries or vehicle damage.

Split limit liability has three limits of coverage: bodily injury per person, bodily injury per accident and property damage. You might see policy limits of 25/50/10 which stand for $25,000 in coverage for each person's injuries, a total of $50,000 of bodily injury coverage per accident, and property damage coverage for $10,000. Some companies may use a combined single limit or CSL which limits claims to one amount and claims can be made without the split limit restrictions.

Liability insurance covers claims such as emergency aid, structural damage, medical expenses, pain and suffering and loss of income. How much coverage you buy is your choice, but buy as large an amount as possible. Washington state law requires minimum liability limits of 25/50/10 but you should consider buying more coverage.

Collision coverage

This pays to fix your vehicle from damage resulting from colliding with an object or car. A deductible applies and then insurance will cover the remainder.

Collision insurance covers things like crashing into a ditch, damaging your car on a curb, hitting a parking meter, crashing into a building and backing into a parked car. Paying for collision coverage can be pricey, so analyze the benefit of dropping coverage from vehicles that are older. You can also increase the deductible on your HR-V to bring the cost down.